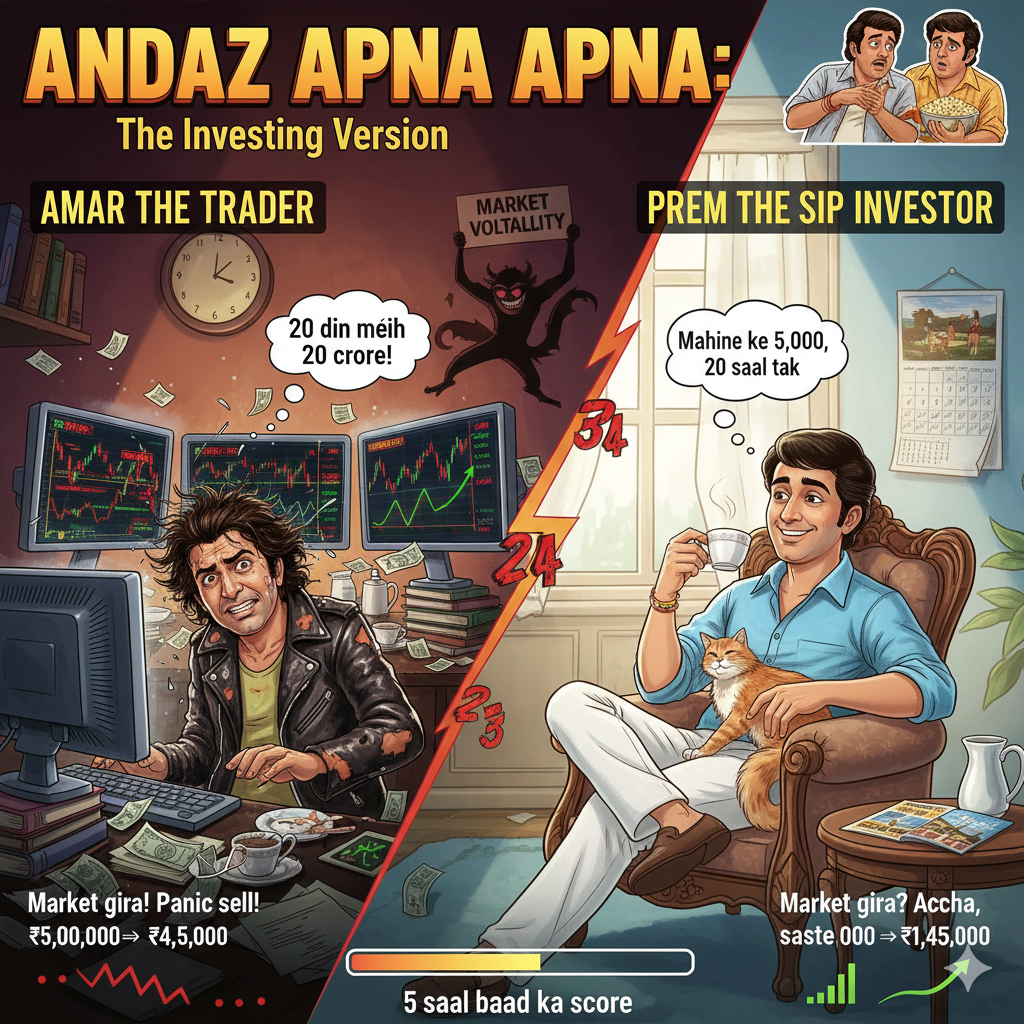

Amar vs Prem: The Andaz Apna Apna Investing Battle!

The get-rich-quick schemer who believes in “Teja main hoon, mark idhar hai!” approach to investing. Always looking for shortcuts, tips, and overnight miracles.

The simple, sincere fellow who believes in “Maine apna kaam kar diya” approach. Sets up a SIP and forgets about it while living his best life.

Amar’s Brilliant Plan

“Yaar Prem, maine ek YouTube video dekha hai! 20 din mein 20 crore! Day trading hai future! Main kal se shuru kar raha hoon. Market mein entry, exit, stop loss, candlestick patterns… main toh Teja ban jaunga!”

(Amar spends ₹50,000 on a “Master Trader” course, buys three monitors for his setup, and starts following 15 trading influencers on Twitter)

Prem’s Simple Approach

“Amar, maine mutual fund wale bhaiya se baat ki hai. Unhone bola ₹5,000 mahine ka SIP lagao aur bhool jao. 20 saal baad dekhna. Main toh wahi kar raha hoon. Simple hai na?”

(Prem sets up an auto-debit of ₹5,000 for a diversified equity fund, gets a confirmation SMS, and goes back to watching Andaz Apna Apna for the 47th time)

The Battle Lines Are Drawn! Amar’s adrenaline-filled trading journey vs Prem’s “set it and forget it” SIP strategy.

Amar During Market Correction

“ARE YAAR! Market 5% gira! Main toh panic sell kar diya! Ab 30% loss ho gaya hai! Lekin wait… ab ye influencer bol raha hai buy the dip… lekin ye doosra influencer bol raha hai market aur girega… kya karu main?!”

(Amar sells at a loss, then FOMO-buys back at higher price, then sells again. His portfolio looks like a心电图 of a heart attack patient)

Prem During Same Market Correction

“Amar, kya hua? Aaj market gaya? Accha… toh mera SIP aaj saste units khareedega na? Waah! Maine toh kuch khaas notice nahi kiya. Kal office cricket match hai, tu aayega?”

(Prem’s SIP auto-debits ₹5,000, buying more units at lower NAV. He’s busy practicing his cricket shots for tomorrow’s match)

| Aspect | Amar (The Trader) | Prem (The SIP Investor) |

|---|---|---|

| Stress Levels | Heart rate matches Bitcoin volatility 📈❤️📉 Sleeps with phone in hand |

Sleeps like a baby 😴 Forgot he even has investments |

| Time Spent | 6 hours/day watching charts Missed 3 family functions |

15 minutes to set up SIP Attended all weddings, got free food |

| Portfolio Value | ₹4,50,000 (Started with ₹5,00,000) “But my next trade will recover everything!” |

₹1,45,000 (Invested ₹1,20,000) 20% returns without checking |

| Broker’s Love | Broker sends Diwali gifts 🎁 (Amar pays more in brokerage than returns) |

Broker forgot he exists (Zero maintenance, all automated) |

| Current Status | Buying “Advanced Candlestick Patterns – Part 7” course Convincing himself “next month will be different” |

Planning Europe trip with SIP returns Still watching Andaz Apna Apna happily |

📊 FUN FACT: 95% of day traders lose money. Meanwhile, SIP investors who stay invested for 10+ years have 90%+ probability of positive returns. Prem might be simple, but he’s statistically smarter!

Lesson 1: “Teja main hoon, mark idhar hai” doesn’t work in markets.

Amar thought he could outsmart everyone. Market laughed and took his money. Markets have been around longer than any of us and are smarter than all of us combined.

Lesson 2: “Maine apna kaam kar diya” works brilliantly.

Prem did his one job – set up SIP. The fund managers did their job. Compounding did its job. Everyone happy, returns aaye!

Lesson 3: More screens ≠ More money.

Amar had 3 monitors showing charts. Prem had 1 phone showing Andaz Apna Apna. Guess who’s happier?

Lesson 4: Consistency beats genius every time.

Amar’s “genius” trades vs Prem’s boring ₹5,000 every month. The tortoise wins again!

Lesson 5: Your broker is not your “Raju Guide”.

They make money when you trade. SIP brokers make money when you stay invested. Align incentives!

Be a Prem, Not an Amar! 🎬

Stop trying to be the “Crime Master Gogo” of trading who ends up falling flat. Be the simple, sincere Prem who gets rich slowly while enjoying life. Your future self will thank you (and probably watch Andaz Apna Apna in a home theater bought with SIP returns!).

Prem: Bhai, main toh SIP kar raha hoon. Tension hi nahi liya market ka kabhi.

Amar: Toh tera portfolio?

Prem: Badh raha hai bhai. Tu bhi karle. Phir dono Europe ghoomne chalenge.

Amar: Par main toh trader hoon…

Prem: Haan pata hai. Isliye tu abhi tak ghoom nahi paya.”

Special Offer: Start your SIP today and get a free reminder to watch Andaz Apna Apna every year on your SIP anniversary! 🎉

Trading

Amar at 45

“Yaar, abhi tak woh Lamborghini nahi aa payi. Par main sure hoon next big trade se aa jayegi. Actually, maine ek NFT course liya hai… yeh naya trend hai!”

(Still checking charts, still taking losses, still buying courses. Has become a “seasoned” trader with 20 years of experience making the same mistakes)

King

Prem at 45

“Amar, kal main Europe se aaya. Woh Lamborghini ki baat kar raha tha na? Main toh SUV le liya family ke liye. Ab SIP ka returns ₹2 crore cross kar gaya hai. Chalo, Andaz Apna Apna dekhte hain – treat mera!”

(His ₹5,000 monthly SIP grew to ₹2.1 crores at 12% returns. He still doesn’t know what candlestick patterns are, and he’s perfectly happy about it)

📈 THE SIP MAGIC: ₹5,000/month for 20 years at 12% = ₹50 lakhs invested → ₹2.1 crores!

That’s the power of being boring like Prem while Amar tries to be exciting and ends up with… well, excitement but no money.

⚠️ Disclaimer (The Boring But Important Part): This is a humorous take on investing principles. Amar and Prem are fictional characters from the cult classic Andaz Apna Apna. Mutual fund investments are subject to market risks. Please read all scheme related documents carefully. Past performance is not indicative of future returns. We’re not saying trading can’t work – we’re saying for 95% of people, SIP works better with less stress. Be like Prem. Your blood pressure will thank you.