How Mutual Funds Actually Work in India: The Complete Journey from AMC to Investor

For millions of Indians, mutual funds have become the vehicle of choice for wealth creation. But how many of us truly understand the machinery behind the scenes? The journey of your SIP rupee from your bank account to a diversified portfolio is a fascinating tale of regulation, expertise, and trust. Let’s peel back the layers and understand, in depth, how mutual funds actually work in India.

Core Concept in a Nutshell

A mutual fund is a trust that pools money from many investors with a common financial goal. This pool is then managed by a professional Asset Management Company (AMC), which invests it in stocks, bonds, gold, or other assets, depending on the fund’s objective. Each investor owns units, which represent a portion of the holdings of the fund.

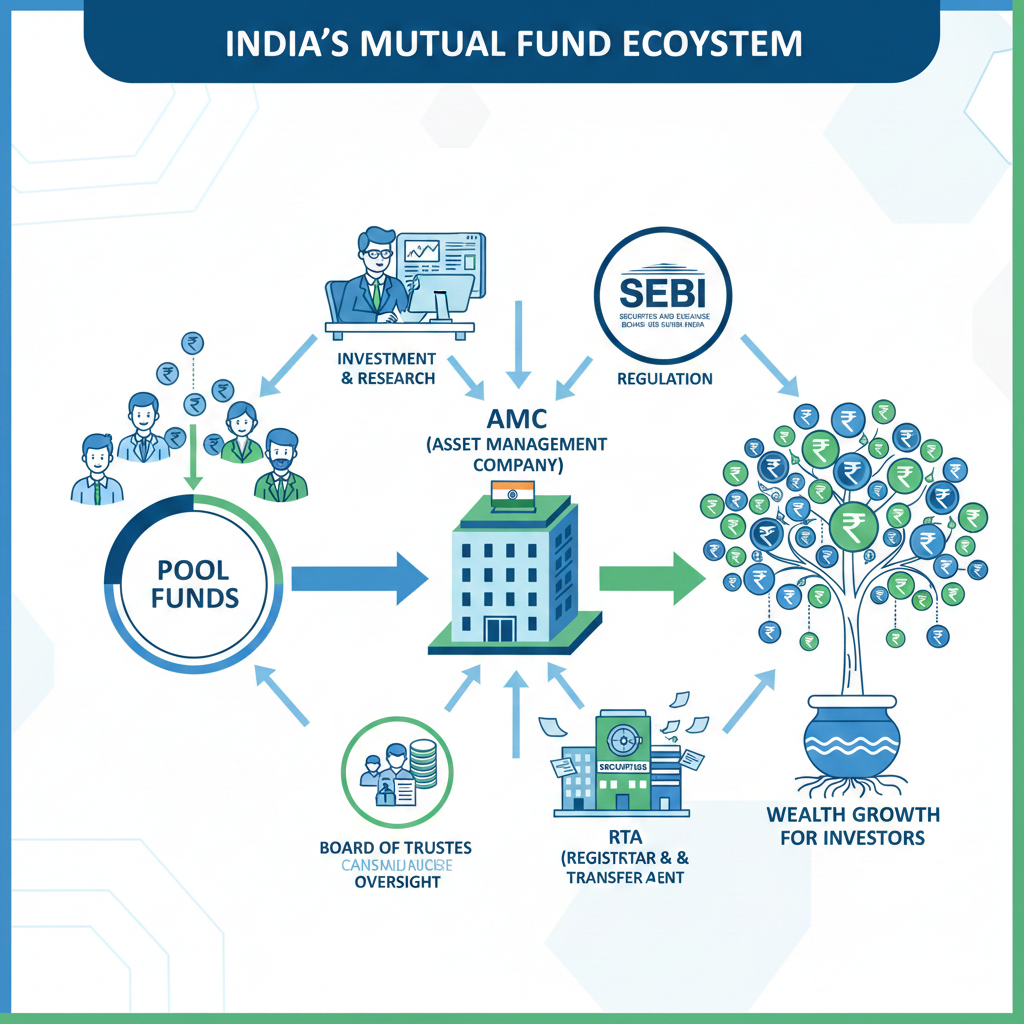

The Key Players in the Indian Mutual Fund Ecosystem

The system is designed with multiple layers to ensure safety, transparency, and professional management. Here’s who’s involved:

1. The Investor (You)

The starting and end point. You provide the capital with an expectation of returns based on your risk appetite and goals.

2. The Sponsor

The entity that establishes the mutual fund. They are the promoters (like HDFC, ICICI, SBI, Aditya Birla, etc.) who set up the fund and appoint the Trustees. They must have a sound track record and contribute a minimum net worth.

3. The Trust & Trustees

The mutual fund is constituted as a trust under the Indian Trusts Act, 1882. The Trustees (a board of individuals or a trust company) are the guardians of the investors’ interests. They are appointed by the Sponsor but have a fiduciary responsibility to act independently. They oversee the AMC’s operations and ensure compliance with SEBI regulations.

4. The Asset Management Company (AMC)

This is the public face of the mutual fund. The AMC (e.g., HDFC AMC, Nippon India AMC) is appointed by the Trustees to manage the investors’ money. They are responsible for investment decisions, research, operations, marketing, and everything related to running the schemes. They charge a fee for this, called the Expense Ratio.

5. The Fund Manager

The star of the show, employed by the AMC. This is the expert (or team) who makes the daily buy/sell decisions, constructing the portfolio to achieve the fund’s stated objectives. Their skill and strategy are crucial to the fund’s performance.

6. Registrar and Transfer Agent (RTA)

Often an outsourced entity (like CAMS or KFin Technologies), the RTA handles the critical back-office work: processing your transactions, issuing account statements, calculating NAV, managing investor records, and providing customer service.

7. Distributors & Platforms

Intermediaries like independent financial advisors (IFAs), banks, online platforms (Zerodha Coin, Groww, etc.), and brokerages that connect you to the mutual fund. They earn a commission (trail fee) from the AMC for their services.

8. The Custodian

A separate entity (like a bank) that physically holds the securities (shares, bonds) bought by the fund. This ensures the safekeeping of assets and separates them from the AMC, adding a layer of security.

9. The Regulator: Securities and Exchange Board of India (SEBI)

The omnipotent watchdog. SEBI frames all rules regarding mutual funds—from what they can invest in, how they can charge, what they must disclose, and how they advertise. Their regulations are designed to protect you, the investor.

The Flow of Your Money: A Visual Journey

INVESTOR → (via Distributor/Platform) → AMC → RTA → Custodian (Securities) & Market (Investment)

Your money never physically goes to the AMC. It goes to the fund’s bank account. The AMC only gives instructions on where to invest it.

The Heart of the Matter: Key Mechanics Explained

Net Asset Value (NAV): The Price Tag

NAV = (Total Assets of the Fund – Total Liabilities) / Total Number of Units Outstanding

Think of total assets as the current market value of all stocks/bonds the fund holds plus any cash. Liabilities include fees owed. The NAV, calculated daily, is the price at which you buy (enter) or sell (exit) a fund. It reflects the fund’s underlying value per unit.

Expense Ratio: The Cost of Management

This is the annual fee the AMC charges to manage the fund, expressed as a percentage of the fund’s average daily assets. It includes management fees, administrative costs, marketing costs (12b-1), etc. It is deducted daily from the fund’s assets, which is why the NAV is reported “after expenses.” Lower expense ratios generally benefit long-term investors.

Types of Schemes: Where is Your Money Invested?

- Equity Funds: Primarily invest in shares of companies. High risk, high potential return. (E.g., Large-Cap, Small-Cap, Sectoral funds).

- Debt Funds: Invest in government securities, bonds, debentures. Lower risk than equity, but sensitive to interest rate changes.

- Hybrid Funds: Mix of equity and debt in varying proportions.

- Solution-Oriented Schemes: Like retirement or children’s funds, with lock-in periods.

- Index Funds & ETFs: Passively track a market index like Nifty 50.

The SIP & Lumpsum Mechanics

SIP (Systematic Investment Plan): You instruct your bank to send a fixed amount to the AMC at regular intervals. On the SIP date, the AMC/RTA calculates how many units you get at that day’s NAV. This instills discipline and averages your purchase cost.

Lumpsum: A one-time investment where you buy units at the NAV of a single day.

The Complete Cycle: From Your Decision to Your Returns

- Decision & Transaction: You choose a fund via research or advisor and place an order (online/offline).

- Allotment of Units: Your money reaches the fund. The RTA allots you units based on the NAV applicable (for mutual funds, it’s typically the day’s NAV if the order is placed before the cut-off time).

- Portfolio Management: The fund manager, following the scheme’s mandate, invests the pooled money (including yours) into a diversified portfolio.

- Ongoing Valuation: The value of the portfolio changes daily with market movements. The NAV is calculated and published daily.

- Generating Returns: Returns come from:

- Dividends/Interest earned by the fund’s holdings.

- Capital Gains when the fund sells securities at a profit.

- Exit/Redemption: When you sell your units, you get money based on the day’s NAV multiplied by your units. The amount is credited to your bank account after deducting any exit load (if applicable for early redemption).

Transparency & Safety: Why This Structure is Robust

The strict segregation of roles is key. The AMC manages but does not hold securities (Custodian does). The Sponsor sets up but does not control day-to-day decisions (Trustees oversee). SEBI regulates everyone. Your units are held securely in a dematerialized form (like shares), and all transactions are recorded by the RTA. Regular disclosures of portfolio holdings, NAV, and expense ratio are mandated.

FAQs: Clarifying Common Doubts

Q1. Is my money safe if the AMC shuts down?

A: Yes. The mutual fund’s assets are held separately by the Custodian in the name of the trust. They are not on the AMC’s balance sheet. If the AMC winds up, the Trustees will appoint a new AMC to manage the portfolio. Your investments are not liquidated.

Q2. How do AMCs and distributors make money?

A: AMCs earn primarily from the Expense Ratio. Distributors earn an upfront commission (on new investments) and a trail commission (a small annual percentage of the assets they brought in, as long as you stay invested). Direct plans have no distributor commission, hence a lower expense ratio.

Q3. What’s the difference between Direct and Regular plans?

A: The underlying portfolio is identical. In a Regular Plan, you invest through a distributor who gets a commission. In a Direct Plan, you invest directly with the AMC (via their website or a direct platform). Direct plans have a lower expense ratio (no distributor fees), leading to slightly higher returns for you over the long term.

Q4. Can NAV go to zero?

A: Technically, it’s extremely rare for a diversified mutual fund NAV to hit zero. It would require all underlying investments to become worthless. However, funds can underperform and give negative returns.

Conclusion: A Symphony of Regulated Expertise

Understanding how mutual funds work in India demystifies the investment process and empowers you to make better choices. It’s a brilliantly structured system where regulation (SEBI), governance (Trustees), expertise (AMC/Fund Manager), and operations (RTA/Custodian) work in concert to pool the resources of millions and put them to work in the capital markets. As an investor, your job is to choose the right instrument (fund) based on your goal and risk, understand the costs involved, and stay invested for the long haul, leveraging the power of this system for your financial growth.

Remember, investing in mutual funds isn’t just about picking a top performer; it’s about trusting a system designed for transparency, diversification, and professional wealth management.

Disclaimer: This article is for educational purposes only. Please consult with a certified financial advisor before making any investment decisions. Mutual fund investments are subject to market risks, read all scheme related documents carefully.