Union Budget 2026-27

A Progressive Budget for Sustainable Growth & Inclusive Development

Total Expenditure

₹52.8 Lakh Crore

Fiscal Deficit

5.2% of GDP

Growth Estimate

7.5% for FY27

Tax Collections

₹27.3 Lakh Crore

Budget Overview

The Union Budget for the financial year 2026-27, presented by Finance Minister today, focuses on sustainable growth, infrastructure development, and social welfare. With a total expenditure of ₹52.8 lakh crore, this budget aims to balance fiscal consolidation with growth imperatives while providing relief to middle-class taxpayers.

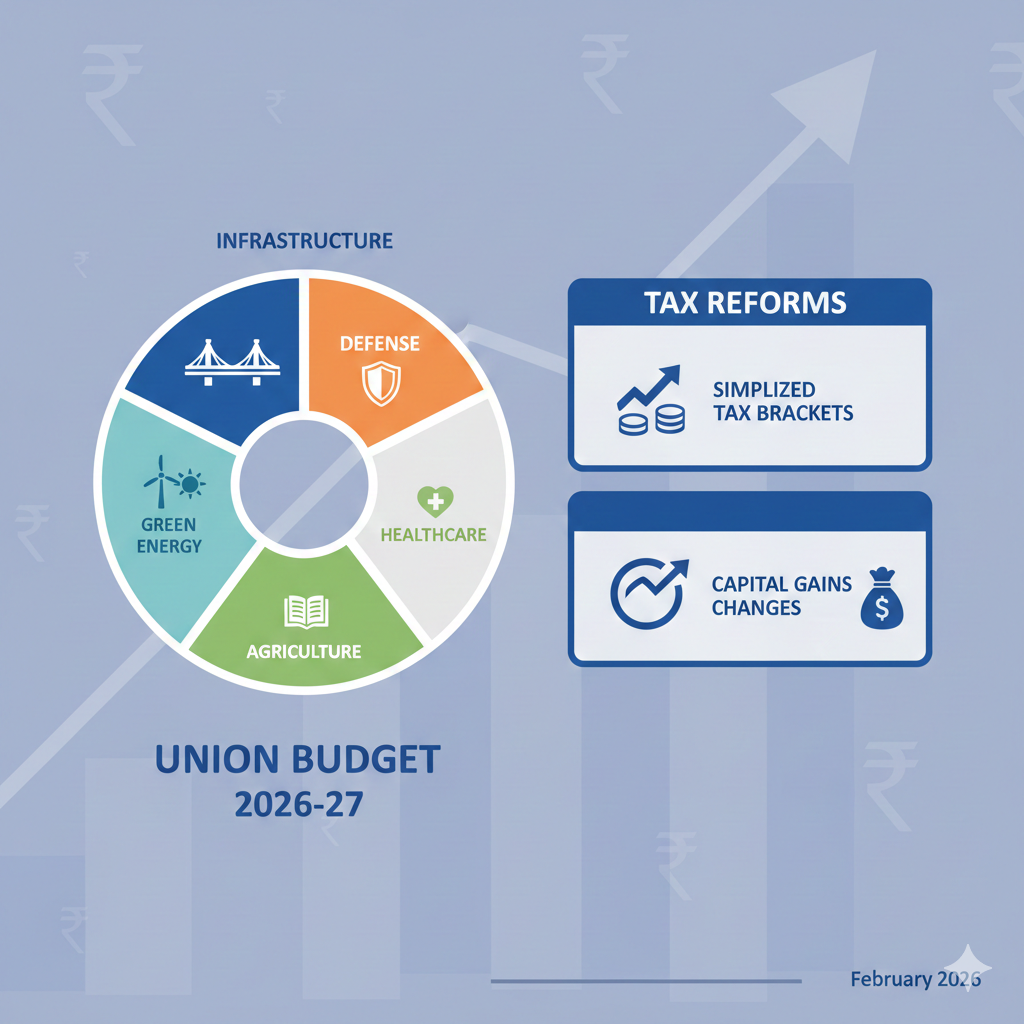

Budget Focus Areas

The budget emphasizes four key pillars: Infrastructure Development, Green Energy Transition, Healthcare Expansion, and Agricultural Modernization. A significant portion of the budget is allocated to capital expenditure, which sees an 18% increase over the previous year, signaling the government’s commitment to long-term growth.

Major Budget Allocations

Here’s a breakdown of where the maximum budget has been allocated for FY 2026-27:

Infrastructure & Transport

Largest allocation with focus on roads, railways, airports, and urban transport systems.

Defense

Modernization of armed forces with emphasis on indigenous manufacturing.

Education & Skill Development

Focus on digital education infrastructure and vocational training programs.

Healthcare

Expansion of Ayushman Bharat and strengthening primary healthcare centers.

Agriculture & Rural Development

PM-KISAN extension, irrigation projects, and support for organic farming.

Green Energy Transition

Solar power expansion, green hydrogen mission, and EV infrastructure.

Changes in Direct Taxes

The budget introduces several significant changes to the direct tax regime aimed at providing relief to individual taxpayers while simplifying the tax structure.

- New Tax Slabs: Introduction of a new simplified tax regime with reduced rates. The exemption limit increased from ₹3 lakh to ₹3.5 lakh for individuals below 60 years.

- Standard Deduction Enhancement: Increased from ₹50,000 to ₹75,000 for salaried individuals under the old tax regime.

- Senior Citizen Benefits: Higher exemption limit of ₹5 lakh for senior citizens (increased from ₹3 lakh). Additional deduction of ₹50,000 for medical insurance premium.

- Capital Gains Tax Rationalization: Long-term capital gains tax on equity investments reduced from 10% to 8% for gains above ₹1 lakh. Holding period for debt mutual funds qualifying as long-term reduced to 2 years (from 3 years).

- Housing Sector Boost: Additional deduction of ₹50,000 on home loan interest for first-time homebuyers for houses valued up to ₹50 lakh. Extension of affordable housing benefits till March 2028.

- Surcharge Adjustment: Surcharge on individual income above ₹5 crore increased from 37% to 42% to enhance progressivity in the tax structure.

- Startup Benefits Extended: Tax holiday for eligible startups extended by 2 years till March 2028. Additional deductions for investments in green technology startups.

- NPS Benefits Enhanced: Additional tax deduction of ₹25,000 for new NPS subscribers under Section 80CCD(1B). Employer contribution limit increased from 10% to 12% of salary.

Key Takeaways

Capital Expenditure Boost

18% increase in capex to stimulate economic growth

Green Focus

Record allocation for renewable energy and sustainability

Tax Relief

Simplified tax structure with benefits for middle class

Manufacturing Push

PLI schemes expanded to 10 new sectors

Important Note

This budget analysis is based on the announcements made on February 1, 2026. Detailed provisions will be available in the Finance Bill, which will be discussed in Parliament. Taxpayers should consult with financial advisors for personalized advice based on their specific circumstances.