Active vs Passive Mutual Funds in India: Which Strategy Wins?

Ready to Start Your Investment Journey?

Whether you choose Active or Passive funds, taking the first step is crucial. Get personalized advice and start investing today with ZFunds.

START INVESTING NOWFor Indian investors, the debate between active and passive mutual funds has intensified in recent years. With the exponential growth of passive investing globally and the consistent performance of many active fund managers in India, choosing the right approach can be confusing. This 2 analysis delves deep into both strategies, comparing costs, performance, suitability, and future outlook to help you make an informed decision.

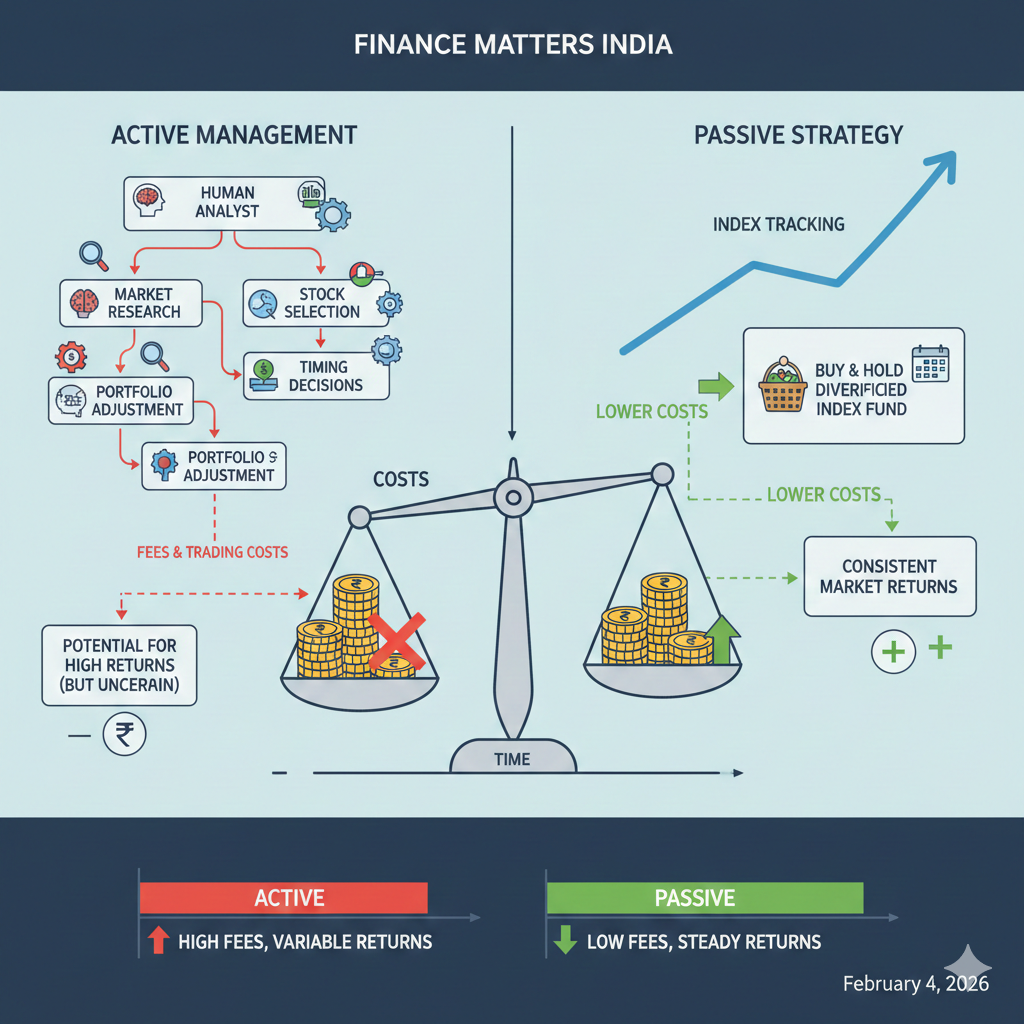

Understanding the Core Concepts

Active Mutual Funds

Active funds are managed by professional fund managers who aim to outperform a specific benchmark index (like Nifty 50 or Sensex). They use in-depth research, market forecasts, and proprietary strategies to select stocks they believe will beat the market. The goal is to generate alpha – excess returns over the benchmark.

Passive Mutual Funds (Index Funds & ETFs)

Passive funds simply replicate and track a market index. They don’t try to beat the market but aim to mirror its performance. An Index Fund or an Exchange Traded Fund (ETF) tracking the Nifty 50 will hold the same stocks in the same proportion as the index. The primary goal is to minimize tracking error (the difference between the fund’s and index’s returns).

Key Differences: A Head-to-Head Comparison

| Parameter | Active Mutual Funds | Passive Mutual Funds |

|---|---|---|

| Investment Objective | Outperform the benchmark index | Replicate the benchmark index performance |

| Fund Management | Hands-on, by a dedicated fund manager & research team | Automatic, rules-based with minimal intervention |

| Portfolio Turnover | High (Frequent buying/selling) | Very Low (Only changes when index constituents change) |

| Risk Profile | Can be higher or lower than index based on stock selection | Mirrors the risk of the underlying index |

| Ideal Market Condition | Inefficient markets, high volatility, stock-picker’s market | Efficient markets, long-term bullish trends |

The Deciding Factor: In-Depth Cost Analysis

Cost is the most predictable differentiator and has a massive impact on long-term wealth creation due to the power of compounding.

Expense Ratios: The Annual Drag

The Total Expense Ratio (TER) is the annual fee you pay to the fund house for management, administration, and other operational costs. It is deducted daily from the fund’s Net Asset Value (NAV).

| Fund Type | Typical Expense Ratio Range in India (Equity) | Impact on ₹10 Lakh investment over 20 years* |

|---|---|---|

| Active Funds (Regular Plan) | 1.5% – 2.5% per annum | ₹23 – ₹39 Lakhs in total fees |

| Active Funds (Direct Plan) | 0.5% – 1.2% per annum | ₹7 – ₹17 Lakhs in total fees |

| Index Funds | 0.1% – 0.5% per annum | ₹1.2 – ₹6 Lakhs in total fees |

| ETFs | 0.05% – 0.2% per annum | ₹0.6 – ₹2.4 Lakhs in total fees |

*Assumes 12% pre-expense annual return. Figures are illustrative.

Other Cost Components

| Cost Type | Active Funds | Passive Funds |

|---|---|---|

| Portfolio Turnover Cost | High (Brokerage, STT, Impact Cost) | Negligible |

| Exit Load | Usually 1% for exits within 1 year | Very rare or zero |

| Transaction Cost for Investor (Brokerage) | Zero for Mutual Fund platforms | Zero for Funds; Brokerage for ETFs on exchange |

Key Insight: A difference of just 1% in expense ratio can lead to a difference of over ₹20 lakhs on a ₹10 lakh investment over 20 years. This “fee compression” is the strongest argument for passive investing.

Not Sure About the Right Fund Type For You?

Connect with a financial advisor at ZFunds who can analyze your goals and risk profile to recommend the perfect active or passive fund strategy.

GET PERSONALIZED ADVICEPerformance in the Indian Context: Does Active Management Deliver?

The Indian equity market has historically been less efficient than developed markets like the US, offering more opportunities for skilled fund managers to find undervalued stocks.

The Success Rate of Active Funds in India

Data from SPIVA (S&P Indices Versus Active) India Scorecard shows mixed results:

- Over the short term (1-3 years): A significant majority of active large-cap funds underperform the S&P BSE 100 index.

- Over the long term (5-10 years): A higher proportion of active funds in the mid-cap, small-cap, and ELSS categories have managed to outperform their benchmarks.

The Mid & Small-Cap Edge: Active management has shown more consistent alpha in the mid and small-cap space in India. The inefficiency and research gap in these segments allow talented fund managers to add value.

Which is Better for You? A Suitability Framework

| Investor Profile | Recommended Strategy | Reasoning |

|---|---|---|

| Beginner / Hands-Off Investor | Passive Funds (Index Funds/ETFs) | Low cost, simple, eliminates fund manager selection risk, ensures market-matching returns. |

| Cost-Conscious & Disciplined Long-Term Investor | Passive Funds (Core) + Some Active (Satellite) | Use low-cost index funds as the core portfolio (70-80%) and add active funds in segments like mid/small-cap for potential alpha. |

| Seeking Alpha in Specific Segments | Actively Managed Mid/Small-Cap or Sector Funds | If you believe in a fund manager’s ability to capitalize on market inefficiencies in these spaces. |

| Investor with High Tax Concerns | Index Funds/ETFs (for lower turnover) | Lower portfolio turnover in passive funds leads to fewer capital gains distributions, potentially improving tax efficiency. |

Frequently Asked Questions (FAQ)

1. Is passive investing always better than active investing?

No, it’s not absolute. In efficient markets like large-cap US stocks, passive often wins. In India, especially in mid & small-cap segments, skilled active managers have a history of outperformance. However, identifying such consistent managers in advance is challenging.

2. Are index funds risk-free since they track the market?

No. Index funds carry the same market risk (systematic risk) as the index they track. If the Nifty 50 falls 20%, your Nifty 50 Index Fund will also fall similarly. They do not protect against market downturns.

3. Can I invest in both active and passive funds?

Absolutely. A popular hybrid strategy is the “Core and Satellite” approach. Use a low-cost passive fund (like a Nifty 50 Index Fund) as the stable “core” of your portfolio (60-70%). Use actively managed funds as “satellites” (30-40%) in areas where you believe active management can add value, like mid-cap or thematic funds.

4. What is tracking error in passive funds?

Tracking Error measures how closely a passive fund follows its benchmark. A lower tracking error (ideally below 0.5%) is better. It arises due to expenses, cash holdings, and sampling techniques. Always check the tracking error before investing in an index fund or ETF.

5. Will active funds become obsolete in India?

Unlikely in the near future. As markets mature, active outperformance may diminish, but India’s growing economy, vast universe of stocks, and developing market characteristics will likely continue to provide opportunities for skilled stock pickers, particularly outside the largest companies.

Conclusion: A Balanced Verdict for Indian Investors

The “better” choice isn’t universal; it’s personal. For most retail investors seeking equity exposure, starting with a low-cost, broad-market passive fund (like a Nifty 50 Index Fund) is a robust, no-fuss foundation. It guarantees market returns at a minimal cost.

However, for those willing to do the research (or work with a good advisor) to select proven fund managers, adding active funds in the mid and small-cap space can be a strategic satellite to potentially enhance returns. The critical lesson is to never ignore costs. Whether active or passive, always opt for Direct Plans to save on distribution fees and maximize your compounding potential.

The Indian market offers room for both strategies to coexist. Your decision should hinge on your financial goals, risk tolerance, investment horizon, and belief in market efficiency.

Begin Your Smart Investing Journey Today

Don’t let analysis paralysis stop you. Build a cost-effective, goal-oriented portfolio with expert guidance. Click below to explore curated active and passive fund options on ZFunds.

CREATE YOUR OPTIMAL PORTFOLIO NOW