The Psychology Behind Investing & Spending

How Mental Biases, Emotions, and Social Forces Shape Our Financial Decisions

Introduction: The Hidden Forces of Financial Behavior

Money decisions are rarely purely logical. Despite access to more financial information than ever before, people consistently make choices that defy rational economic models. The reason lies in the complex interplay between our evolved psychology and modern financial environments. Understanding these psychological forces isn’t just academic—it’s essential for making better financial decisions, avoiding common pitfalls, and developing healthier relationships with money.

Financial behavior is driven less by spreadsheet calculations and more by deep-seated psychological patterns, many of which evolved for survival in vastly different environments. Our brains use mental shortcuts (heuristics) and emotional responses that served our ancestors well but often mislead us in modern financial contexts where delayed gratification, statistical thinking, and risk assessment are required.

Cognitive Biases: The Mind’s Financial Shortcuts

Cognitive biases are systematic thinking errors that affect our judgment and decision-making. In financial contexts, these biases operate below our conscious awareness, steering us toward predictable errors.

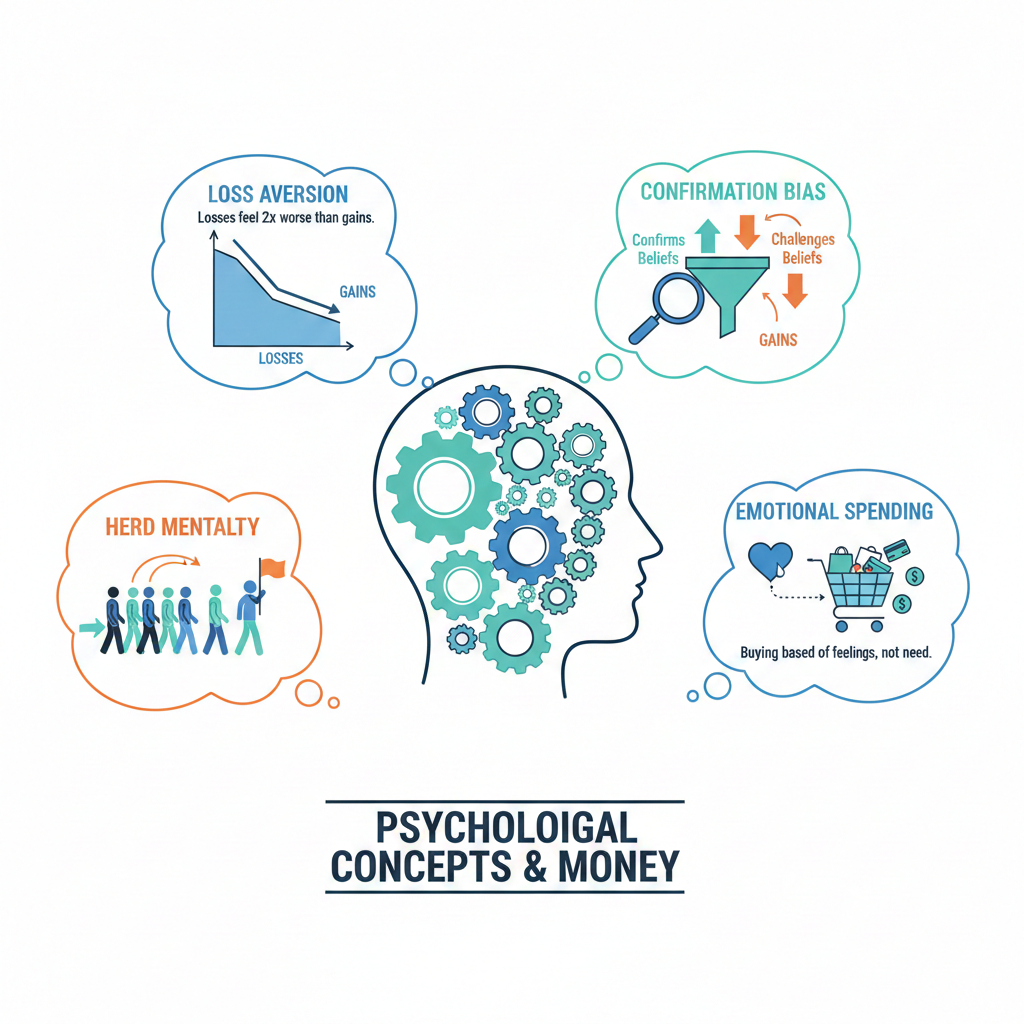

Psychologists Daniel Kahneman and Amos Tversky discovered that losses are psychologically about twice as powerful as gains. This explains why people often sell winning investments too early (to “lock in gains”) while holding losing investments too long (to avoid “realizing the loss”). This bias creates a powerful inertia against selling assets at a loss, even when doing so would be financially prudent. In spending, loss aversion makes us overly sensitive to price increases and reluctant to cancel subscriptions we no longer use—because stopping feels like a loss.

We naturally seek, interpret, and remember information that confirms our existing beliefs while ignoring contradictory evidence. An investor might only follow news sources that support their bullish outlook on a particular stock. A spender might justify luxury purchases by focusing on the item’s quality while ignoring their budget constraints. This bias creates echo chambers in our financial thinking, preventing us from making balanced decisions based on all available information.

We rely too heavily on the first piece of information we encounter (the “anchor”) when making decisions. If a stock once traded at $100, we mentally anchor to that price and perceive it as “cheap” at $70—even if fundamental analysis suggests it’s overvalued. In spending, retailers use anchoring strategically by showing “original” prices next to sale prices, making discounts appear more significant. Our initial exposure to price points creates reference points that shape all subsequent value judgments.

Most people believe they’re above-average investors, drivers, and spenders—a statistical impossibility. Overconfidence manifests in excessive trading (which typically lowers returns), under-diversification (“I know this one company really well”), and failure to adequately plan for financial risks. Studies show that the most active traders often achieve the worst returns, precisely because overconfidence leads them to believe they can outsmart the market.

Emotional Drivers: When Feelings Override Logic

Emotions powerfully influence financial decisions, often overriding logical analysis. Understanding these emotional triggers can help us recognize when we’re making feeling-based rather than fact-based money choices.

Many people use shopping as an emotional regulation tool—buying things to feel better when stressed, anxious, bored, or sad. The temporary mood boost from acquisition activates the brain’s reward centers, creating a powerful reinforcement loop. However, this often leads to buyer’s remorse, financial strain, and clutter. The fleeting pleasure of purchase rarely addresses the underlying emotional need, creating a cycle of repeated emotional spending.

French philosopher Denis Diderot described how a new purchase can trigger a cascade of additional spending. Buying a new suit might make your shoes look shabby, prompting shoe shopping, which then makes your briefcase seem outdated. This “spending spiral” occurs because we seek consistency in our possessions and self-image. Marketers exploit this by selling “complete looks” or “ecosystems” of products that encourage complementary purchases.

When we perceive something as limited or temporarily available, we’re more likely to buy it—often without proper consideration. “Limited time offers,” “last chance” sales, and “only 3 left in stock” notifications trigger primal scarcity responses. In investing, FOMO drives people to buy assets during bubbles because they fear missing out on gains everyone else seems to be enjoying. This urgency short-circuits careful analysis and leads to impulsive decisions.

Social & Cultural Influences

We don’t make financial decisions in a vacuum. Social comparisons, cultural norms, and peer influences significantly shape our money behaviors.

We naturally compare ourselves to others, particularly those slightly above us in social hierarchy. When peers upgrade cars, homes, or vacations, we feel pressure to match these visible consumption patterns—a phenomenon called “lifestyle inflation” or “keeping up with the Joneses.” This social competition can prevent wealth accumulation regardless of income level, as spending rises to meet (or exceed) peer standards rather than personal needs or goals.

Humans are social creatures who find safety in following the crowd. In investing, this creates bubbles (when everyone buys) and crashes (when everyone sells). The dot-com bubble, housing bubble, and cryptocurrency surges all featured powerful herd behavior. Herd mentality provides psychological comfort (“if everyone’s doing it, it must be right”) but often leads to buying high and selling low—the exact opposite of sound investment strategy.

- Focuses on future gains

- Requires delayed gratification

- Thrives on patience & discipline

- Benefited by rational analysis

- Vulnerable to fear & greed cycles

- Success often invisible (compound growth)

- Focuses on immediate satisfaction

- Provides instant gratification

- Driven by emotion & impulse

- Exploited by marketing

- Triggers reward centers instantly

- Results immediately visible

Neurological Foundations

Modern neuroscience reveals how financial decisions play out in the brain, explaining why we often struggle with money choices that seem straightforward on paper.

Neuroeconomists identify two competing systems: the prefrontal cortex (responsible for logical analysis, future planning, and impulse control) and the limbic system (associated with emotions, rewards, and immediate gratification). Financial decisions activate both systems, creating internal conflict. When we see something we want to buy, the limbic system screams “GET IT!” while the prefrontal cortex cautions “consider your budget.” Whichever system wins this neural tug-of-war determines our financial behavior.

Research shows that spending money literally activates brain regions associated with physical pain. However, payment method changes this experience. Cash payments trigger the strongest “pain” response, making us more mindful spenders. Credit cards dull this pain through temporal separation (payment comes later) and abstraction (no physical money changing hands). Digital payments and “one-click” purchasing further reduce payment pain, encouraging more spending.

Strategies for Better Financial Psychology

Understanding these psychological forces is only valuable if we apply this knowledge. Here are evidence-based strategies to improve financial decision-making:

Establish mandatory waiting periods before major purchases (24 hours for moderate purchases, 30 days for significant ones). This allows emotional impulses to fade and rational analysis to emerge. For investments, create an “investment policy statement” that outlines your strategy in advance, helping you stick to it during market volatility.

Remove emotion from recurring decisions by automating savings, investments, and bill payments. Behavioral research shows that people who automate savings save significantly more without feeling deprived. “Out of sight, out of mind” applies positively to wealth accumulation.

Record spending decisions along with your emotional state and reasoning. Review this journal monthly to identify patterns between moods and spending. This mindfulness practice increases self-awareness and helps break automatic spending habits driven by emotional states.

Instead of focusing on portfolio balances (which fluctuate daily), track consistent behaviors: savings rate, investment consistency, debt reduction. Instead of focusing on purchase price, calculate cost-per-use for items. These reframes shift attention to factors within your control.

While mental accounting can be problematic, it can also be harnessed. Create separate savings accounts for different goals (“emergency fund,” “vacation,” “home down payment”). This makes abstract financial goals tangible and protects designated funds from being reallocated impulsively.

Actively seek information that challenges your financial assumptions. Follow analysts with different viewpoints, consider the opposite of your investment thesis, and play “devil’s advocate” with your spending rationalizations. This deliberate practice counteracts confirmation bias.

Conclusion: Mastering the Inner Game of Money

The psychology behind investing and spending reveals a fundamental truth: financial success depends less on finding the perfect investment strategy or budgeting app, and more on understanding and managing our own minds. By recognizing cognitive biases, emotional triggers, and social influences, we can begin to make financial decisions more consciously rather than automatically.

The most valuable financial skill isn’t stock picking or coupon clipping—it’s self-awareness. Recognizing when you’re acting from fear versus logic, when social pressure is influencing your decisions, or when you’re seeking emotional relief through spending represents the foundation of true financial intelligence. This psychological mastery transforms money from a source of stress into a tool for creating the life you want.

As you navigate your financial journey, remember that every money decision is simultaneously a psychological decision. The numbers matter, but the mindset matters more. By aligning your financial behaviors with your deepest values rather than fleeting impulses or social comparisons, you create not just wealth, but financial well-being—the peace of mind that comes from knowing your money choices reflect who you truly are and what you genuinely value.