How to Choose the Right Bank Account in India: A Detailed Guide for 2026

In India’s dynamic financial landscape, your bank account is more than just a vault for your money—it’s a gateway to UPI payments, investment options, loan facilities, and financial security. With Public Sector Banks (PSBs), Private Banks, Small Finance Banks (SFBs), Payment Banks, and Cooperative Banks all vying for your attention, making the right choice is crucial. This comprehensive guide will help you cut through the noise and select an account that perfectly aligns with your अर्थव्यवस्था (financial life).

Step 1: Audit Your Financial Behaviour (अपने वित्तीय व्यवहार की जांच करें)

Your lifestyle dictates your banking needs. Begin by asking:

- Cash Dependency: Do you frequently deal in cash (e.g., for local vendors, household help) requiring regular cash deposits/withdrawals?

- Digital Native or Branch Reliant: Are you comfortable using UPI, Net Banking, and Apps for 99% of transactions, or do you prefer in-branch service for deposits, drafts, or queries?

- Transaction Volume & Type: How many UPI/IMPS/NEFT/RTGS transactions do you make? Do you issue cheques regularly?

- Account Purpose: Is this for salary credit, business transactions, building an emergency fund, or for a senior citizen/parent?

- Balance Maintained: What is your average monthly balance (AMB)? This is key to avoiding penalties.

Step 2: Navigate the Indian Account Ecosystem

Indian banks offer a suite of accounts tailored to different segments.

A. Savings Accounts: The Universal Starting Point

- Regular Savings Account: The standard offering from all banks. Features vary widely in terms of Minimum Average Monthly Balance (MAB) requirements (from zero to ₹10,000+), ATM limits, and digital features.

- Basic Savings Bank Deposit Account (BSBDA): A “No-Frills” account mandated by RBI. Zero MAB, free cheque book (limited), ATM card, and a cap on withdrawals. Ideal for financial inclusion.

- Salary Account: Offered through employer tie-ups. Usually zero MAB, free unlimited transactions, premium debit cards, and personal accident/health insurance covers. Caution: It may convert to a regular account with fees if your salary stops crediting.

- Women’s/Senior Citizens/Student Accounts: Tailored products with lower MAB, preferential interest rates (slightly higher), and specific benefits like discounted locker fees or insurance.

- High-Interest Savings Accounts: Offered by some private and small finance banks (e.g., IDFC FIRST, Kotak, RBL). Offer interest rates of 3-7% p.a., often conditional on maintaining higher balances or using specific services.

B. Current Accounts: For Business & High-Volume Transactions

Designed for businesses, firms, and entrepreneurs. Offer unlimited transactions, no interest on deposits, and come with overdraft facilities. Charges are based on turnover, not just MAB.

| Account Type | Best For | Typical MAB Requirement | Key Indian Consideration |

|---|---|---|---|

| Regular Savings | Most individuals | ₹1,000 – ₹10,000+ | Check free ATM/UPI limits; Branch network |

| BSBDA (No-Frills) | Minimal banking needs, students | ₹0 | Transaction limits apply; Mandatory for all banks |

| Salary Account | Salaried professionals | ₹0 (while employed) | Bundled benefits; Can convert later |

| Senior Citizen Account | Individuals aged 60+ | Low or ₹0 | Higher interest (0.5% extra), priority service |

| Current Account | Businesses, HUF, Traders | ₹10,000 to ₹1 Lakh+ | Charges on turnover; OD facility key |

Step 3: The Indian-Specific Evaluation Checklist

1. Charges & Penalties (The Fine Print)

- Minimum Average Monthly Balance (MAB): The most common charge. Failing to maintain it can incur penalties of ₹200-₹500 + GST per month. Choose an account with an MAB you can comfortably maintain.

- ATM & Transaction Charges: While 5 free ATM transactions per month in other banks’ ATMs is standard (RBI mandate), check charges beyond that. Also, note limits on free UPI/IMPS transactions.

- Debit Card Annual Fees: Many basic cards are free. Premium cards (Platinum, Signature) may have annual fees, but often come with rewards, lounge access, or insurance.

- Fund Transfer Charges: NEFT/RTGS charges are now waived by most banks for digital transactions (as per RBI). Confirm this.

- SMS Alert Charges: Often ₹15-₹25 + GST per quarter. Sometimes waived if MAB is maintained.

2. Interest Rates & Inflation Beating

Savings account interest rates in India are low but vary. Public sector banks often offer 3-4% p.a., while some private and small finance banks offer 4-7% p.a. Calculate interest on daily outstanding balance. For real growth, link your savings account to higher-yield instruments like Fixed Deposits (FDs), Recurring Deposits (RDs), or mutual funds.

3. Digital Infrastructure is Non-Negotiable

- Mobile Banking App: Should be intuitive, secure, and stable. Features to demand: UPI integration (like BHIM), instant FD/RD opening, investment platform, bill payments, and credit card management.

- Net Banking: Should offer comprehensive services, including tax payments (IT, GST), advanced fund transfers, and statement downloads.

- Customer Service: 24×7 phone banking, chat support, and grievance redressal via the Banking Ombudsman scheme.

4. Branch & ATM Network

If you live in a metro, most banks suffice. For tier 2/3 cities or rural areas, the presence of PSBs like SBI, PNB, Bank of Baroda or regional rural banks is a significant advantage for cash transactions and service needs.

5. Value-Added Services & Ecosystem

Does the bank offer easy integration with its own or third-party investment platforms? What about quick personal loan or credit card approvals for account holders? Locker availability (with a waitlist considered)? These create a holistic financial ecosystem.

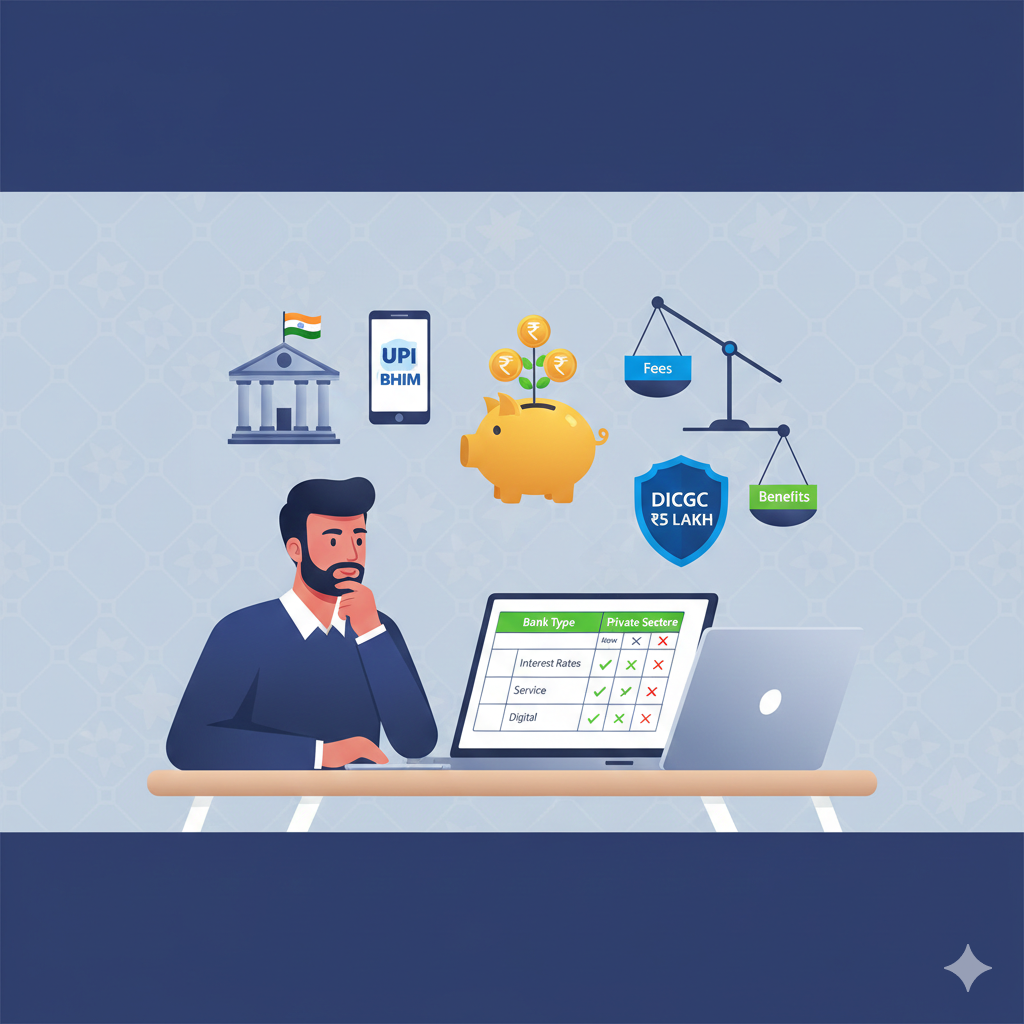

Step 4: Bank Category Showdown – Where to Open?

Public Sector Banks (SBI, PNB, Canara, etc.)

Pros: Vastest network, trust, lower charges, strong government backing. Cons: Technology can be lagging, service speed variable.

Private Sector Banks (HDFC, ICICI, Axis, Kotak, etc.)

Pros: Superior technology, customer service, innovative products. Cons: Higher MAB requirements, more aggressive cross-selling.

Small Finance Banks (AU, Equitas, Ujjivan, etc.) & Payment Banks (Airtel, Paytm Payments Bank*)

SFB Pros: Very competitive interest rates on savings & FDs, focus on underserved segments. Cons: Smaller network, brand trust building.

*Note: Payment Banks have restrictions (can’t lend, offer FDs; max balance ₹2 lakh). Good for basic transactions.

Step 5: The Account Opening Process in India

- KYC Documents: You will need PAN Card and Aadhaar Card (mandatory). Also keep a passport-sized photo, and proof of address (if address not as per Aadhaar).

- In-Person or Video KYC (V-KYC): Many banks now offer fully digital account opening through Aadhaar-based e-KYC or video KYC, completed in minutes.

- Initial Deposit: Be ready with the initial amount, which can be as low as ₹500 for many regular accounts, or ₹0 for BSBDA.

- Set Up & Secure: Immediately register for net/mobile banking, set up UPI PIN, activate transaction alerts, and register your nominee.

Final Verdict: Be a Informed Banking Consumer

Choosing a bank account in India is no longer about just the passbook. It’s about choosing a financial partner for your digital life, your aspirations, and your security. Prioritize low friction (fewer charges, easy tech), good returns (on savings), and reliable service.

Review annually. Is your MAB still feasible? Has a competitor launched a better product? Are you paying unnecessary SMS charges? Your banking needs at 25 are different from those at 45. Exercise your right to switch via the RBI’s Savings Account Portability guidelines if needed, though the process is still evolving.

Take charge. Your ideal bank account is out there, waiting to power your financial journey. Choose wisely, and let your money not just sit, but work efficiently for you in the world’s fastest-growing economy.